Ok, now that my little disclaimer is out of the way, let me tell you how much I dread tax season!

I have always done our taxes until the last year. With it being a good problem to have we had entered into a more complex situation and decided it was in our best interest to have an accountant do our taxes starting last year. It was the best decision we ever made! (well at least one of them).

I had been working the numbers and at best I had us still owing about $1000.00 by the time he got done with our numbers and asked us lots of questions we no longer owed money but actually got some back. We were thrilled no matter the amount just to now owe.

He provided us with some information about things we would want to track especially since my husband is law enforcement there are a lot of things that are tax deductible for us that we had no idea. So I developed or shall I say tweaked the system I already had.

I call this my life! It is my life in a note book. I do not carry a check registry, I keep all the documentation right here in this little notebook.

As you can tell the notebook has several pocket holders and dividers. The first section I keep important things like bills, receipts, my tracking sheet for paying bills off (which is the sheet that you can see says Feb). I have all our bills listed out with the approximate bill due and the due date and they are split in two by pay days (basically the 1st and the 15th - this started back when my husband was in the military). I check off each bill as I pay it so I can visually see a reminder that bill has been paid.

Behind the first section I then have what some would call a check register. It's just on notebook paper and it is easier for me to track and write down.

There is another divider with tabs and this is where I keep important information like phone numbers, VIN and license numbers for our cars and drivers (I get asked for this more than you would think), mileage rates to common destinations (you will need this a lot for tax purposes).

Here is how I list the places that I frequent enough to list them. For instance as you can see I have our Dr.'s listed for each of us (and this is not in OCD order but for now it has to get the trick done). I also have places we would purchase work supplies, school donations, and prescriptions. These are common for a lot of people and I track the mileage one-way because I know I can multiply by 2 because we always have a round trip to get the stuff (not sure if this is the best way but it is how I do it.)

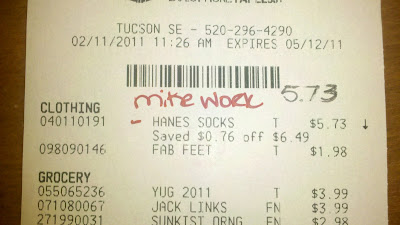

As we make purchases or go to the Dr. throughout the year I keep everything! I document on the top of the receipt or paper what it is for so I can track it better. FYI - the receipts they print out now often have all the ink erased by the end of the year so I will circle or bracket the item and then write the total at the top.

I take this information that I have collected and I put it into a spreadsheet at least once a quarter - trust me do not wait until the end of the year or you will want to pull your hair out! There are always last minute things that I have to scramble to get and I was so thankful this year that I had updated my spreadsheet at least quarterly.

I keep track of all my receipts in my file folder. I have a file folder for each year and they are not expensive at all.

Although you can see the tab that says medical - in my spreadsheet I will separate the medical out per person in our house to just be very clear on the expenses. I also have all the charity going into one file but I also have to separate this out to actual items or money donated or the value of items such as the totals of when I donate items to Goodwill or Salvation Army. These are entered into the tax worksheet separately and it makes it easier for our accountant.

Some things we hadn't considered (but glad I kept the receipt) was the insulation we bought for the inside of our garage door. It was Energy Star certified and was a tax deduction we could take under home improvements. It wasn't a huge amount but I figure every little bit counts and I am glad I kept that receipt.

My spreadsheet broken down:

Medical - each person has a sheet within the spreadsheet workbook.

Charity Items - again cash or donated items (exact cost to buy and donate) and then a separate sheet for the used items donated to places such as Goodwill.

Michael's Work Expenses

Shanna's Work Expenses

I do go ahead and put the formula in the spreadsheet because it will add my totals and mileage as I go so I don't have to do manually.

I am so glad I have been doing this because our accountant said this year our tax return figures were a direct result of my hard work all year long tracking expenses.

No comments:

Post a Comment